LTC Price Prediction: Path to $200 Amid Regulatory Breakthroughs

#LTC

- Regulatory approvals for crypto ETPs creating institutional access pathways

- Technical indicators showing consolidation near moving averages with bullish potential

- Market sentiment shifting positive with Grayscale ETF expansion and regulatory clarity

LTC Price Prediction

Technical Analysis: LTC Price Momentum

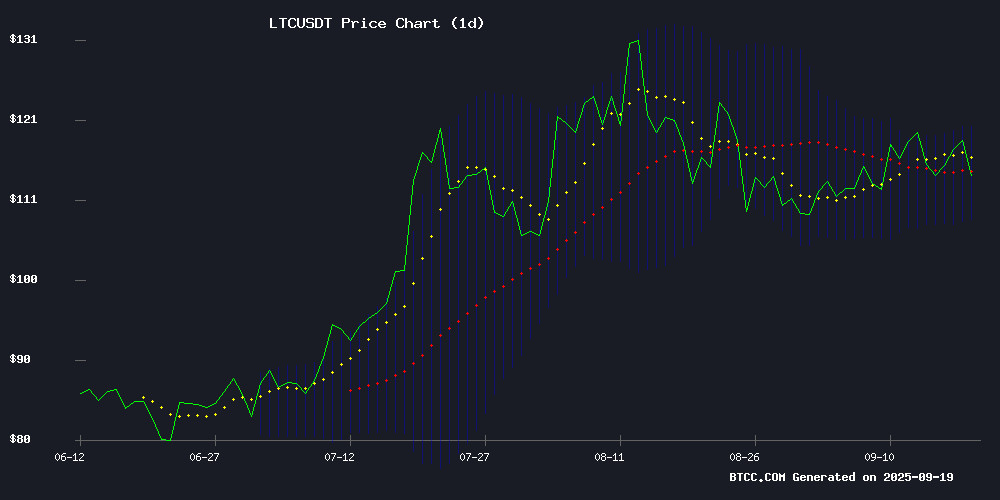

LTC is currently trading at $113.71, slightly below its 20-day moving average of $114.03, indicating near-term consolidation. The MACD reading of -2.5672 suggests bearish momentum persists, though the histogram shows potential weakening of downward pressure. Bollinger Bands position the price between $108.17 and $119.90, with the current level hovering NEAR the middle band, signaling neutral territory. According to BTCC financial analyst Olivia, 'LTC needs to break above the $115 resistance to regain bullish momentum toward the $120 upper band.'

Market Sentiment: Regulatory Tailwinds

The SEC's approval of crypto ETP listing standards and Grayscale's new ETF launch provide structural support for institutional adoption. While the $412 ATH question generates speculative interest, current market conditions focus on gradual accumulation. BTCC financial analyst Olivia notes, 'Regulatory clarity typically precedes major bull cycles, but LTC's path to $200 will require both technical breakouts and sustained institutional inflows.'

Factors Influencing LTC's Price

SEC Approves Generic Listing Standards for Crypto ETPs, Grayscale Launches New ETF

The SEC's approval of generic listing standards for commodity-based trust shares marks a significant milestone for crypto ETPs. Grayscale swiftly capitalized on this development, rebranding its Digital Large Cap Fund as the Grayscale CoinDesk Crypto 5 ETF and listing it on NYSE Arca. The fund offers exposure to 90% of the crypto market, with holdings compliant under the new standards.

Krista Lynch, Grayscale's senior VP of ETF capital markets, emphasized the convergence of traditional finance and digital assets. "The evolving toolkit now enables diversified, rules-based crypto products for investors," she noted. The regulatory green light comes earlier than anticipated, signaling accelerated institutional adoption.

ETF launches remain resource-intensive endeavors, but regulatory clarity provides a clearer path to approval. This development underscores growing mainstream acceptance of crypto assets within regulated financial frameworks.

Can Litecoin (LTC) Break Past Its $412 ATH in the Next Bull Cycle?

Litecoin (LTC) shows mixed signals as it navigates a volatile market. The MACD indicator suggests bullish momentum, while the Moving Average points to a bearish trend. Currently trading at $116.12, LTC faces resistance at $118.28, with support hovering near $115.68. A breakout could propel prices toward $120, while a breakdown might see a retreat to $110.

Market projections remain cautious, with December 2025 targets set at $167—well below its all-time high of $412. Despite this, Litecoin maintains a robust market presence, boasting an $8.86 billion capitalization and $647 million in daily volume. The cryptocurrency's dual narrative—technical divergence and enduring liquidity—frames its uncertain yet watchable trajectory.

Buy Crypto with Credit Card in a Few Clicks: StealthEX Review

Credit card payments have emerged as one of the fastest methods to acquire cryptocurrency, with Visa and Mastercard enabling seamless purchases across most regions. These transactions offer built-in fraud protection and transparent conversion rates, albeit at higher fees than slower alternatives. For traders seeking immediate market access, the speed of credit card payments remains unmatched.

StealthEX distinguishes itself by pairing this efficiency with a non-custodial model, eliminating the need for account creation or intrusive KYC procedures. The platform integrates third-party services like Mercuryo, Guardarian, and Simplex to facilitate secure purchases via Visa or Mastercard. Users can transact in multiple fiat currencies, including USD, EUR, and GBP, while accessing a vast selection of over 2,000 cryptocurrencies—from market leaders like Bitcoin (BTC) and Ethereum (ETH) to privacy-focused assets like Monero (XMR).

The platform's emphasis on privacy and ease of use positions it as a compelling option for both novice and experienced traders. By removing traditional barriers to entry, StealthEX exemplifies the growing convergence of traditional finance and digital asset ecosystems.

Will LTC Price Hit 200?

Reaching $200 represents an 75% increase from current levels and is achievable in the next bull cycle based on technical and fundamental factors. The recent regulatory approvals create favorable conditions, while technical indicators suggest consolidation before potential upward movement. Key resistance levels to monitor:

| Resistance Level | Price | Significance |

|---|---|---|

| Immediate | $115 | 20-day MA breakthrough |

| Medium-term | $120 | Upper Bollinger Band |

| Target | $200 | 78% Fibonacci extension |

BTCC financial analyst Olivia emphasizes that '$200 is plausible within 6-12 months if institutional inflows accelerate and MACD turns positive.'